Bullet journals have recently become extremely popular for personal organizations due to their ability to be personalized to an individual. Typically, bullet journals are used to keep track of events and daily to-do lists. However, with a few creative, custom finance spreads, you can get on top of your finances! Once you get your financial goals down on paper, you will find that it is a lot easier to keep track and meet them. Here are just a few ways you can use a bullet journal to boost your personal finances.

1. Keep an expense log.

First and foremost, the simplest way to get a handle on your finances is to simply find out what it is you are spending on a week-to-week basis. Many of us are anxious to look at our bank accounts because we are afraid that indulging in a bottomless brunch over the weekend or a few new extra clothes splurges has sent us into financial disarray. Instead, many people choose to ignore their bank account and simply pray that their card won't get declined on their next purchase. Keeping a simple expenses log can help alleviate these worries about your spending because you know what you are spending. Making a simple table in your journal detailing the description of the purchase, the cost, the category of the purchase, and whether it is a want or a need, can really help you to visualize your spending pitfalls.

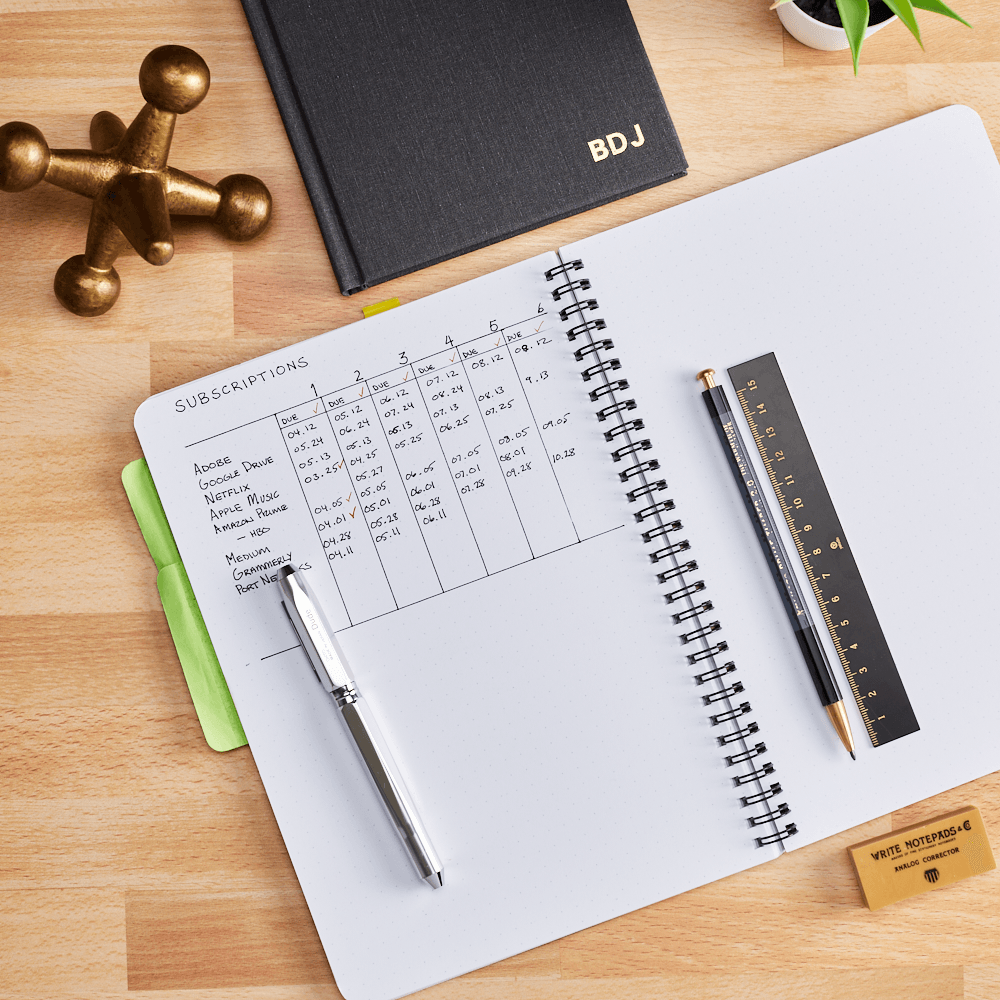

2. Keep track of your income.

Secondly, in order to make a good budget, you need to know what money is coming into your bank account. Whether you work for a company that pays you monthly or you have several side hustles and streams of income, it is good to know how much money you are actually seeing that month. Again, creating a table with the description of the income and the amount is a good start to work out your total income for that month. This spread can also be adapted to couples or people with a shared income. Keeping track of multiple sources of income from the family is a really useful tool for budgeting.

3. Add your finances to a habit tracker spread.

If you are already a bullet journal aficionado, then chances are that you've already heard about the habit tracker spread. By putting all the days of the month on one side of the page, and a list of habits you want to complete daily on the other, you can see how well you are completing habit goals. You can choose whatever financial habit it is you want to work on for this spread. A good idea for a habit is a "no-spend day," but you can adapt this to other goals such as putting money into a savings account, not shopping, or whatever it is you want to specifically work on. Make a mark next to the days you complete this goal, and you can easily see how well you have completed the habit throughout the month.

4. Make a spread for your savings goals.

Another good use of the bullet journal is to help you meet savings goals. Whether you are saving for a vacation or a car, you can track your progress towards these goals. A good way to do this is to create a box that can be colored in for each small increment towards the goal, for example, every $100. If you are a bit more creative, you can design this spread to be a little fancier. You may choose to track the increments of money that you have saved. You can track this information by coloring in boxes in your journal as you reach smaller goals. You can really customize this spread to fit your needs.

5. Use a graph to keep track of your debts and loan payments.

Finally, for the more statistically savvy readers, you can use a bullet journal to create a graph of your re-payment of loans and debt over time. Simply put the amount paid towards a loan on the y-axis and the days of the month on the x-axis, and you can plot your re-payments throughout the month or year. This spread is useful because you can see visually how you are doing to meet your re-payment goals. For some people, it really helps to have a visual representation.

Overall, a bullet journal can be a really useful tool for financial planning. Using these tips, you can improve your finances and become more organized.

Leave a comment